Should you buy Link after the 9% surge on Sunday?

After falling by over 50% in less than a month, ChainLink (LINK/USD) has given its investors a sigh of relief as it was trading almost 10% higher on Sunday. Link has fallen from $30 to $14 in just 15 days and is one of the worst-hit coins in this sell-off. Chainlink is a decentralized network of oracles that enables smart contracts to securely interact with real-world data and services that exist outside of blockchain networks. With Chainlink, the traditional systems that currently power modern economies can connect to the emerging blockchain industry to generate more security, efficiency, and transparency in business and social processes.

After falling by over 50%, Link was trading at the same price that it was back in July thus investors are looking for opportunities to buy Link before it returns back to a higher price. Link still has a strong set of fundamentals thus it is looking like Link got oversold due to panic selling and could thus trade back over the $20 mark soon. However, investors must be cautious and wait for Link to break through a strong resistance before buying as Link could still fall further. It is looking like this could be a beginning of a rally in Link. Thus should you buy Link before it trades back above the $20 mark?

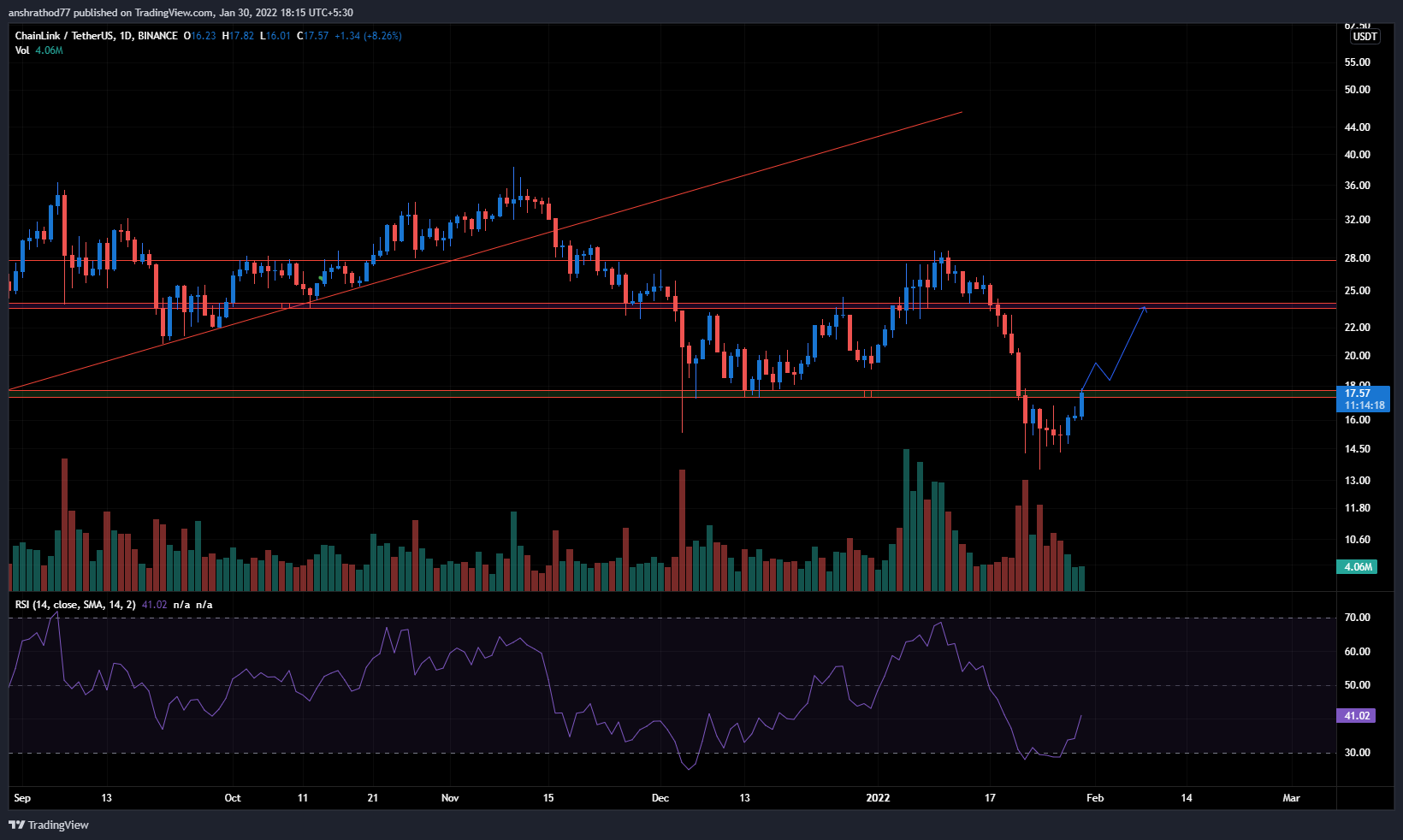

Here is what the charts are pointing towards-

-

Link has strong resistance at $18, thus investors should wait for Link to break through the $18 mark before taking any long entries.

-

A breakout from Link will show strength and confirm a bullish view.

-

The RSI was oversold and thus investors can be seen returning back to buying Link.

-

Investors can set a target of $23, followed by $27.

-

A stop-loss can be set at $15.