NFTs experience first bear market

It’s easy to forget how young NFTs are. The dominant Bored Ape Yacht Club only celebrated its first birthday last month, yet it feels like forever since the cartoon monkeys surged into the mainstream. Birthed during the pandemic-driven trading frenzy, NFTs rode the wave of hysteria right to the very top.

Bear Market

2022 has not been so easy. Prices across all assets have plummeted, as investors frantically hit the SELL button and flee to cash and safe-haven assets. Given the youth of NFTs, let’s take a look at how have they performed amid this changing environment thus far. Additionally, how do we expect them to react going forward, should this turn out to be a prolonged bear market?

Interest

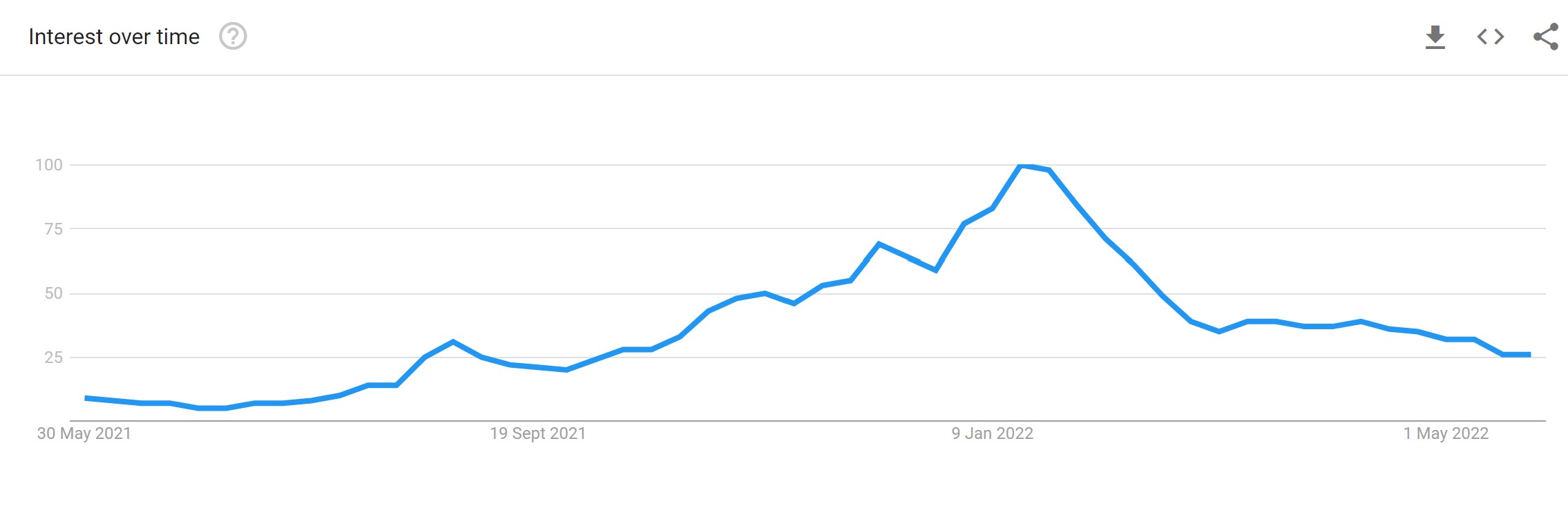

One succinct way to assess sentiment in the space is to have a gander at Google search volume for the term “NFT”. The results are stark – looking at the one-year trend below, the upward growth is clear throughout 2021 before abruptly shifting in late January as the market began to wobble.

Prices

I’m going to use Bored Apes as a proxy here, seeing as they have become by far the most blue-chip of all the collections. The price of the average sale has halved from 160 ETH to 82 ETH in the last month, as seen on the below graph from OpenSea, which is when the contagion really started to ripple through the crypto markets amid the death spiral of Do Kwon’s circus act, more officially known as Luna.

That’s only half the story, too. We still live in a world where USD is King, rather than Ethereum – and the above graph is priced in the latter. In USD terms, the average sale price of a Bored Ape is now $160,000, down from $452,000 since the start of May – that’s a 65% plunge.

As I said, these Apes are blue-chip and the biggest collection on the block; they are the Apple of the magic Internet art space. The cratering in their value is comfortably surpassed by smaller collections, many of which have totally cratered, down 85%, 90%, 95%.

It’s evidence – if there was any doubt – that NFTs very much represent ultra high-risk assets whose demand is largely driven by status, collectability and FOMO. They are as far out on the risk spectrum as it gets, and thus as the macro environment has turned sour and the market dipped, these high-beta assets have been in freefall.

Future

There is no reason to suggest anything will change henceforth if the bear market persists. A highly volatile asset capable of falling 65% in a month is not one that investors will be comfortable holding amid market turmoil. Creators can release all the derivatives, merchandise, exclusive access, perks and whatever other utility-generating features they think of, but if the wider market continues to draw blood, NFTs won’t abort their vertical drop anytime soon.

Many NFT traders have never experienced a bear market before. Welcome to the world of investing and risk, people. It’s never fun seeing that number go down.