Will Binance Coin cross the $500 mark in January?

Binance Coin (BNB/USD) is trading over 10% higher this week, and this could be the start of a fresh rally before BNB breaks out from the parallel channel that it has been trading under. BNB is used as a utility token for the Binance exchange and lets users pay for transactions and trading fees at a lower rate than they would be with other tokens. Binance uses the process of token "burns," meaning they use the profit from token sales to repurchase more BNB and then destroy them. Investors are expecting another strong year from BNB after it rallied by over 1300% in 2021.

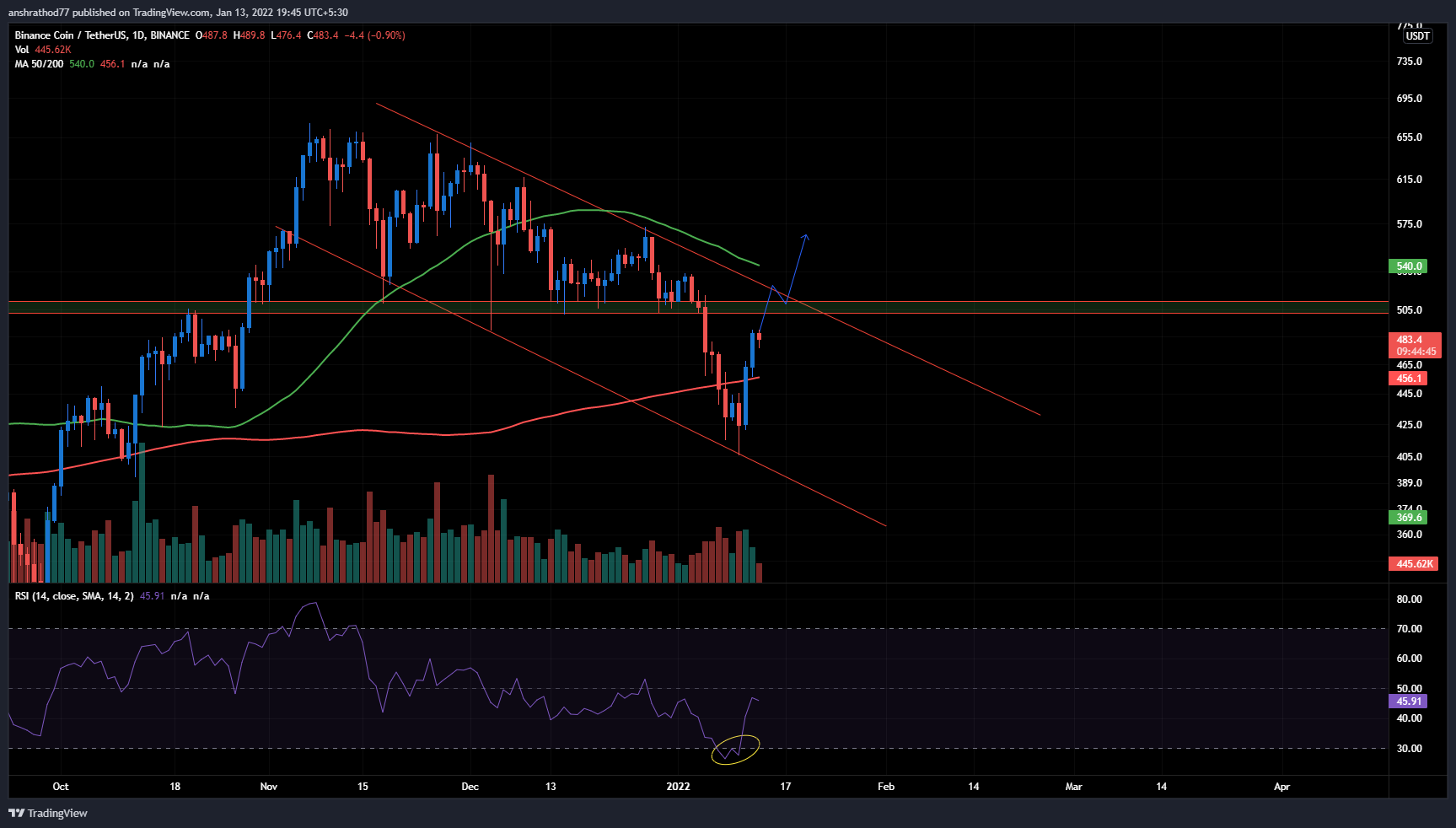

BNB was trading 1% lower on Thursday, however, it is looking like it could be a small pullback before BNB continues its rally. BNB has surged in price by over 10% this week and this could only be the start of the rally. It is now approaching a strong resistance and breaking out from this resistance could show that BNB could soon hit new highs. BNB was oversold earlier this week, which could be the reason for the reversal. Thus should you buy BNB before it resumes the rally?

Here is what the charts are pointing towards-

-

BNB has been trading in a downward channel, however, a breakout could soon be seen. Investors must be patient and wait for BNB to break out from the resistance at $500.

-

BNB saw a sharp sell-off earlier this week, which caused it to be oversold which caused buyers to return and a strong reversal was thus seen.

-

If BNB is able to break out from the channel inventors can expect a target of $600, followed by $664.

-

Investors should only buy BNB above the resistance at $500 as BNB could fall further below if it is not able to cross the $500 mark.