These are the three best-performing exchange coins today

The cryptocurrency market is slowly recovering from its recent slump, and these three exchange coins are some of the best-performing in the market.

The crypto market sustained huge losses over the weekend, with the total market cap dropping to the $1.5 trillion region.

However, the market has been performing well over the past 48 hours. The cryptocurrency market has added more than $200 billion to its valuation during that period.

Bitcoin is trading around the $38k level after rallying by more than 5% over the past 24 hours. The leading exchange coins have also been recovering excellently, with most of them adding more than 4% to their values in the last 24 hours.

Binance Coin (BNB), Crypto.com token (CRO) and FTX token (FTT) are three of the best-performing exchange coins so far today.

Key levels to watch

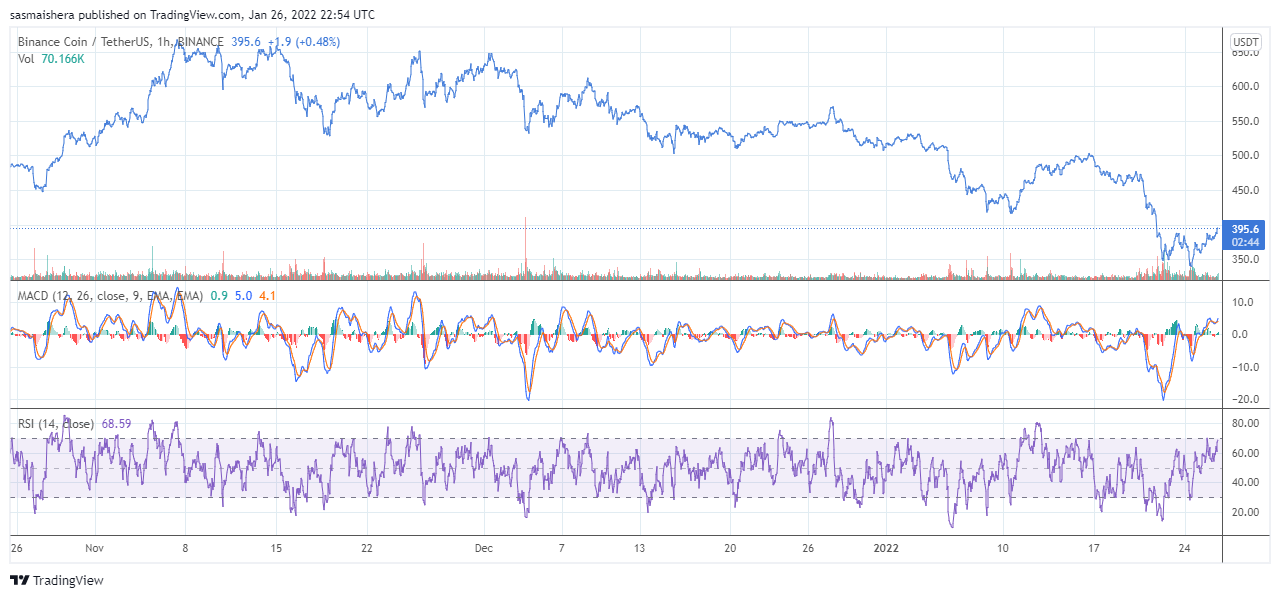

The BNB/USDT 4-hour is bullish, thanks to the cryptocurrency adding more than 5% to its value so far today. The technical indicators are positive as BNB continues its recovery.

At press time, BNB is trading at $391 per coin. The MACD line has crossed the neutral zone as BNB continues to rally. The RSI of 69 shows that BNB could soon enter the overbought region if the positive momentum is maintained.

CRO is the best performer amongst the exchange coins at the moment. The CRO/USD 4-hour chart is extremely bullish, thanks to the coin’s recent performance.

The MACD line is in the positive region as CRO is currently in a bullish state. The RSI of 75 shows that CRO is experiencing huge buying pressure from the market. If the rally continues, CRO could surge past the $0.50 resistance level before the end of the day.

FTT, the native token of the FTX exchange, is also performing well after adding more than 4% to its value so far today. The FTT/USD 4-hour chart is bullish at the moment.

FTT’s MACD line is in the positive region, thanks to the ongoing rally. The 14-day RSI stands at 65, which shows that FTT could soon enter the overbought region if the rally continues.