Should you buy the dip in Theta Token on Friday?

After a huge market sell-off on Friday, Bitcoin (BTC/USD) was trading 8% lower, many coins were deep in the red and huge selling volumes could be seen. Theta Token (THETA/USD) fell by over 13%, investors are now looking at this as an opportunity to buy the dip, however, investors must be cautious as this may not be the end of the sell-off. Numerous coins were trading over 10% in the red however investors must note that they could still fall further down and any long entries should be avoided until a clear reversal is seen.

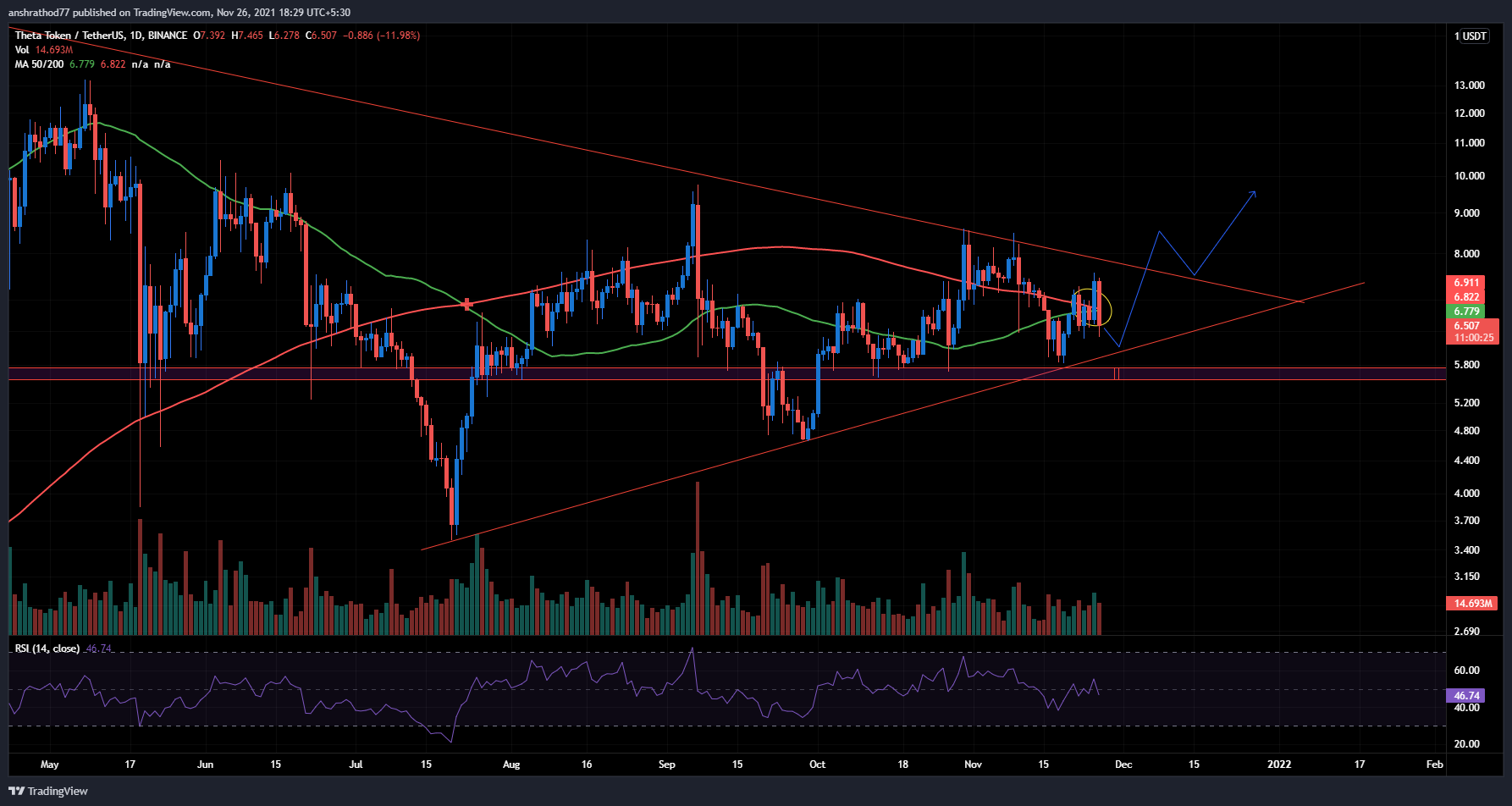

A look at the charts-

-

Theta has formed a symmetrical triangle and has tried breaking out multiple times, however after the dip on Friday it is looking like it will now test the lower trendline.

-

Theta could test the lower trendline soon at $5.9, if Theta is able to reverse from that zone it could give an upper breakout in the coming weeks.

-

Investors must be cautious and should not enter early as Theta could still give a lower breakout, thus any long entries should only be taken once Theta is able to bounce back from the lower trendline.

-

The 50-day and 200-day moving averages are also very close to crossing each other, once a golden crossover is seen it could be an indication of a bullish rally soon.

-

Investors who want a safer entry can enter once Theta crosses the 200-day moving average, which is a bullish indication.

-

A target of $7.8 can be set, and if a breakout is seen a target of $8.7 could also be achieved.

-

A stoploss can be set at $5.6.