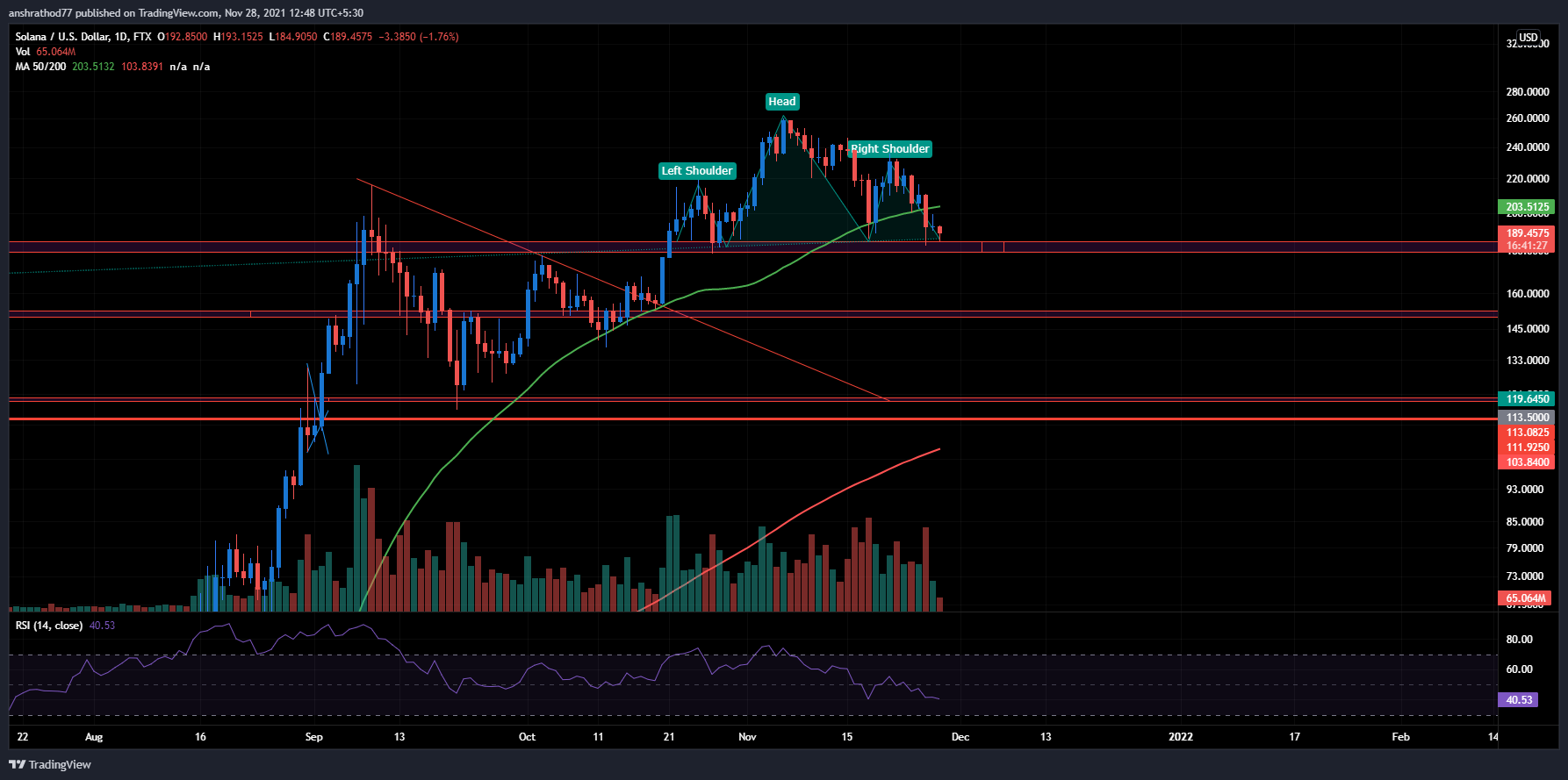

Should you buy Solana as it nears the $180 mark?

Solana (SOL/USD) neared the $180 mark as it fell by over 2% on Sunday, Solana has reversed multiple times from the $180 mark and even started a rally from this level. However, investors are now sceptical of a reversal now as Solana is lacking strength and is also forming a bearish pattern. Many investors are still buying the dip in Solana due to its excellent fundamentals which were one of the reasons for its sharp rally from $180 to $260. However Solana has lost all the gains from the rally in late October, will Solana be able to sustain the $180 mark?

What the charts are pointing towards-

-

Solana sharply corrected from the new all-time high of $264 it hit earlier this month. After falling to $190 after the rally it bounced and went to $235 however it has now fallen back down to $190.

-

Solana is forming a Head and Shoulder pattern, which is a bearish pattern and is indicating a breakdown below the level of $235. Thus any long entries should be avoided until a clear reversal is seen, moreover, investors can also wait for Solana to break the 50-day moving average before taking a long entry.

-

Solana has very strong fundamentals thus, there could be a chance it does not break down below the level of $190.

-

A target of a new all-time high could be set once a reversal is seen.

-

Investors must note that if Solana breaks down from the $190 level, any long entries should be avoided until the $150 mark is approached.

-

A stop-loss can be set below the zone.